In recent years, the financial landscape has seen a significant shift towards sustainable investing, accentuated by the rising prominence of Environmental, Social, and Governance (ESG) criteria. The tumultuous aftermath of economic crises and a growing awareness of climate change have propelled both investors and institutions to critically evaluate how their investments align with their ethical values. In this context, a groundbreaking study titled “Empirical Comparative Analysis of the Performance of European Union Conventional and ESG Bonds” by García-Escobar, Fernández-Guadaño, and Mascareñas has emerged as a beacon of understanding in an evolving market that increasingly prioritizes ethical considerations alongside traditional financial metrics.

At the heart of the study lies an ambitious goal: to statistically evaluate the performance of conventional bonds against their ESG counterparts within the European Union. To many investors, the term “comparison” may invoke visions of performance metrics like yield, volatility, and risk-adjusted returns. Yet, this research delves deeper, exploring not just the financial performance of these bonds, but how societal and environmental factors influence investor behavior and market dynamics. This dual focus provides critical insights that challenge the longstanding notion of investment purely as a financial endeavor.

One of the compelling reasons to scrutinize the bond market, particularly with respect to ESG characteristics, lies in the changing attitudes towards sustainable development and corporate responsibility. Contemporary investors are not merely in search of returns; they increasingly wish for their portfolios to reflect their values. This has steered the allocation towards ESG bonds, which promise not only yields but also a commitment to fostering greater corporate responsibility. The implications of this shift stretch far beyond individual investor choices, potentially influencing the very principles under which companies operate.

In its methodological approach, the study employs empirical data through comprehensive analysis techniques. A variety of datasets were aggregated, covering periods before and after the major pandemic in 2020, to identify trends and shifts in bond performance under distinct market conditions. This longitudinal perspective, juxtaposed with the prevailing economic climate, allows the researchers to draw nuanced conclusions about the resilience of ESG bonds versus conventional alternatives.

What sets this analysis apart is its use of advanced econometric models that accommodate a multitude of variables affecting bond performance. By incorporating data such as interest rates, inflation, and macroeconomic indicators, the study constructs a robust framework to measure the relative performance of ESG and conventional bonds. The findings not only illuminate performance differentials but also highlight potential correlations with broader market phenomena, such as investor sentiment and regulatory changes related to sustainable finance.

Some may wonder if the interest in ESG is merely a fleeting trend, influenced by current events or social movements. However, the study articulates a compelling narrative that suggests otherwise. The researchers present evidence indicating that ESG bonds have maintained a competitive edge, particularly during periods of market volatility. This resilience can be attributed to the evolving regulatory landscape fostering the growth of sustainable finance, as well as increasing consumer demands for corporate accountability.

Despite the optimism surrounding ESG investments, the study does not shy away from addressing the potential drawbacks. Critics often argue that the adherence to ESG criteria may compromise financial performance, particularly in high-growth sectors, where the alignment with environmental standards can be complex. The authors acknowledge these criticisms and explore them articulately, dissecting the risks and challenges that investors may encounter when navigating the ESG landscape. Nevertheless, they highlight the dynamism of the ESG market, asserting that continuous innovation and regulatory support could alleviate many of these qualms.

Beyond performance evaluation, one of the study’s core contributions lies in its discussion on investor perception and behavior. Understanding why investors gravitate towards ESG bonds—beyond mere yield—provides vital insights into the psychological and sociological dimensions of modern investing. The research underscores the confluence of ethical imperatives and financial rationale, revealing that a substantial segment of investors is willing to sacrifice a fraction of returns for the knowledge that their capital contributes to positive societal outcomes.

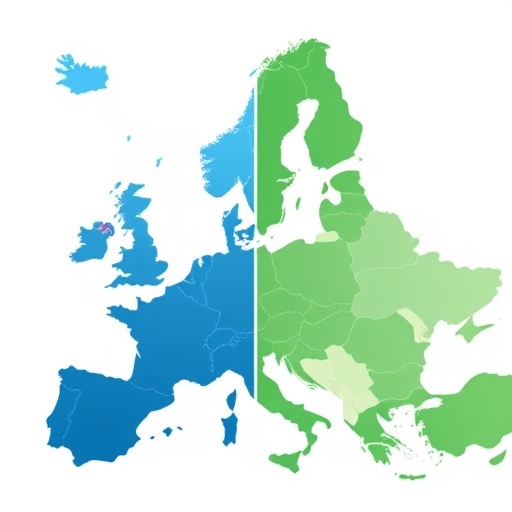

To fortify its conclusions, the study draws comparisons across different countries within the European Union, showcasing the regional disparities in ESG adoption and market performance. This geographical angle enriches the discourse, illuminating the varied responses of financial markets to sustainability initiatives and ethical investing across diverse regulatory frameworks and cultural contexts.

As the findings circulate within financial and academic communities, the implications echo on multiple levels. Investment funds, asset managers, and even policymakers would be prompted to recalibrate their strategies and frameworks in light of demonstrable evidence supporting the efficacy of ESG criteria. The notion that such investments warrant equivalent, if not superior, financial performance could catalyze a larger movement towards responsible investing in Europe and beyond.

Ultimately, the work of García-Escobar, Fernández-Guadaño, and Mascareñas is poised to serve as a significant reference point for future research and policy-making within the realm of sustainable finance. The growing complexity of financial markets necessitates nuanced discussions that marry ethical imperatives with rigorous statistical analysis, a niche the authors have adeptly carved out. As the dialogue around climate change, social justice, and governance evolves, this research underscores a pivotal moment in the finance sector—where sustainable investing is not simply a trend but a foundational shift in how investments are perceived and undertaken.

The study culminates in a call to action for practitioners and academics alike to embrace the evolving landscape of finance, encouraging more in-depth investigations into the intersections of ethical investing and financial outcomes. As the nuances of this field become increasingly sophisticated, understanding the implications of such research will be critical in shaping the future of investing in an era marked by unprecedented challenges and opportunities.

In conclusion, the findings from this empirical comparative study shed light on the convergence of ethical considerations and financial performance within the European bond market. The subtle yet significant advantages of ESG bonds open the door for future investigations, deepening the discourse on sustainable finance and its critical role in shaping a more responsible economic future.

Subject of Research: Comparative performance analysis of ESG and conventional bonds in the European Union.

Article Title: Empirical comparative analysis of the performance of European Union conventional and ESG bonds.

Article References:

García-Escobar, J., Fernández-Guadaño, J. & Mascareñas, J. Empirical comparative analysis of the performance of European Union conventional and ESG bonds.

Discov Sustain (2026). https://doi.org/10.1007/s43621-025-02437-6

Image Credits: AI Generated

DOI:

Keywords: Sustainable investing, ESG bonds, financial performance, empirical analysis, European Union.