In the face of escalating climate crises worldwide, the uncertainty embedded within climate policy frameworks has emerged as a pivotal factor influencing corporate strategic decisions. Particularly in nations like China, where climate regulations and environmental commitments are rapidly evolving, businesses encounter a complex landscape marked by unpredictability and shifting mandates. This uncertainty, referred to as climate policy uncertainty (CPU), represents both a significant risk and a potential catalyst for change in how corporations approach sustainable development. Recent research sheds critical light on the nuanced relationship between CPU and corporate Environmental, Social, and Governance (ESG) performance, revealing a dynamic interplay that could redefine sustainable finance and corporate governance practices at a global scale.

A groundbreaking study published in China Finance Review International explores this intricate nexus by analyzing data spanning over a decade, encompassing nearly 4,500 Chinese publicly traded companies across diverse sectors. By leveraging sophisticated econometric methodologies, the research rigorously investigates how fluctuations in climate policy certainty impact corporate ESG initiatives. Using the 2016 implementation of the Paris Agreement on climate change as a natural experiment, the study applies Difference-in-Differences (DID) techniques alongside Propensity Score Matching (PSM) and endogenous control models such as Two-Stage Least Squares (2SLS) and System Generalized Method of Moments (sys-GMM), ensuring robust and credible findings. This empirical rigor elevates the study’s contributions, linking theoretical perspectives with actionable insights.

One of the study’s most compelling revelations is the overall positive correlation between heightened CPU and improved ESG performance. Contrary to intuitive expectations that uncertainty might retard sustainability efforts, firms respond to policy ambiguity by intensifying their commitment to ESG standards. This effect is particularly pronounced among non-state-owned enterprises (N-SOEs), companies embedded in heavily polluting industries, and those operating within jurisdictions with more stringent environmental regulations. The mechanism underpinning this response seems rooted in risk mitigation strategies, where firms leverage ESG enhancements to navigate systemic uncertainties and safeguard long-term viability.

Delving deeper, the research distinguishes differential impacts across the three ESG dimensions. Environmental (E) and Social (S) components demonstrate significant positive trajectories in response to rising CPU, reflecting increased investments in eco-friendly technologies, emission reductions, workplace safety, and community engagement initiatives. Interestingly, governance (G) scores exhibit a slight decline, highlighting short-lived governance challenges during policy transitions. This counterintuitive governance dip underscores the complex organizational adjustments firms undergo while adapting to new regulatory paradigms, including potential disruptions in board oversight, compliance processes, and managerial accountability structures.

Beyond immediate ESG metrics, these strategic adaptations bear measurable economic consequences. Firms that proactively elevate their ESG performance amid CPU experience reductions in operational risk, evident through decreased return volatility. Additionally, these organizations register marked improvements in total factor productivity (TFP), a comprehensive measure incorporating labor, capital, and technological efficiency. The dual nature of these benefits underscores a crucial paradigm: sustainability efforts are not merely ethical imperatives but also potent drivers of economic resilience and competitiveness in uncertain policy environments.

The broader implications of this research are multifaceted and urgent. For policymakers, the findings advocate for calibrated regulatory frameworks that balance stringency with stability, thereby amplifying the beneficial effects of CPU on corporate ESG engagement. By deploying tailored support mechanisms, governments can incentivize sustainable practices while mitigating potential governance disruptions during policy shifts. This approach aligns with global goals to harmonize climate action with economic growth, weighing risks against rewards in corporate sustainability strategies.

For the corporate sector, the study underscores the strategic importance of embedding ESG considerations into the core business model. Especially for firms outside state control and those in polluting industries, ESG integration emerges as a vital tool to buffer against climate policy volatility, protect reputational capital, and unlock long-term value creation opportunities. The findings encourage enterprises to view ESG not as compliance but as proactive risk management and innovation pathways, transforming uncertainty into competitive advantage.

Investors also stand to benefit from this evolving landscape. ESG metrics become crucial indicators in portfolio risk assessment amid escalating climatic and policy uncertainties. By directing capital towards firms demonstrating robust ESG improvements in response to CPU, investors can bolster portfolio resilience and align financial returns with sustainability trajectories. This dynamic reshapes capital allocation paradigms, integrating environmental and social considerations into mainstream investment decision-making.

Methodologically, this research represents a leap forward in the empirical analysis of CPU’s influence on corporate behavior. Employing panel regression models across a large multi-industry sample, the study addresses endogeneity concerns through instrumental variable approaches and dynamic panel estimations. Such rigor enhances confidence in causal interpretations and sets a benchmark for future inquiries examining the intersection of policy uncertainty and firm-level sustainability outcomes.

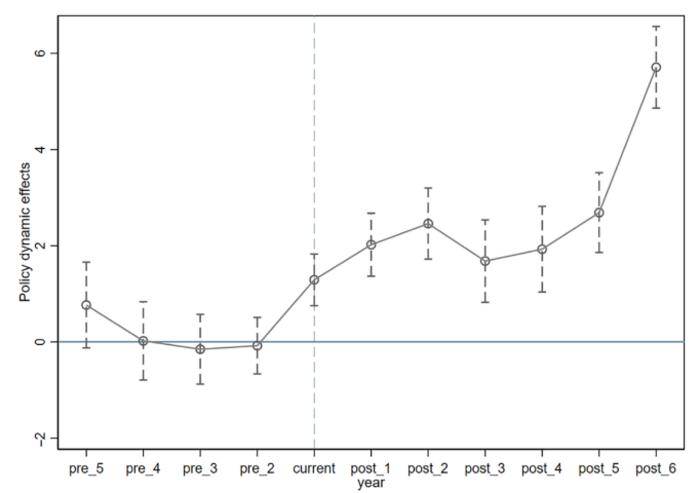

The use of the Paris Agreement’s 2016 adoption as a policy shock serves as an illustrative natural experiment, enabling clear differentiation between pre- and post-policy impacts on ESG metrics. This temporal delineation sharpens the analysis, revealing the dynamic and temporal nature of firms’ responses to international climate governance. The visualization of these effects, complete with confidence intervals, provides a nuanced understanding of how systemic risk factors modulate corporate sustainability efforts over time.

Furthermore, the research shines a light on sectoral and regional heterogeneities. Firms in heavy-polluting industries face pronounced pressure to improve ESG performance as a strategic imperative, reflecting heightened regulatory scrutiny and public expectation. Meanwhile, companies operating in regions with stringent environmental oversight exhibit stronger positive responses, underscoring the local context’s critical role in shaping corporate strategies.

Taken together, these insights contribute to the growing discourse on sustainable finance and corporate responsibility amid global climate challenges. By illuminating the mechanisms through which climate policy uncertainty influences ESG outcomes, the study equips stakeholders with evidence-based guidance to navigate and harness the complexities of climate governance transitions.

In conclusion, the evolving interface between climate policy uncertainty and corporate ESG behavior reveals a paradoxical but optimistic narrative: uncertainty does not merely constrain but can also catalyze enhanced sustainability efforts. This dynamic represents a pivotal opportunity for governments, businesses, and investors alike to align strategies, investments, and policies in support of a resilient, low-carbon future. As climate risks intensify, understanding and leveraging the implications of CPU will become increasingly central to shaping sustainable economic development worldwide.

Subject of Research: Climate policy uncertainty (CPU) and its impact on corporate Environmental, Social, and Governance (ESG) performance in Chinese listed companies.

Article Title: Climate policy uncertainty and corporate ESG performance: evidence from Chinese listed companies

News Publication Date: 11-Mar-2025

Web References: 10.1108/CFRI-05-2024-0272

Image Credits: Zhifeng Dai and Qinnan Jiang (Changsha University of Science and Technology, China).

Keywords: Climate policy, Climate change, Environmental policy, ESG performance, Corporate governance, Sustainable finance, Risk mitigation, Paris Agreement, China, Climate policy uncertainty