In the rapidly evolving world of cryptocurrency, volatility management remains a crucial challenge. Researchers have now developed a novel approach that integrates Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) with genetic algorithms and neural networks to enhance the precision of trading decisions in this volatile market.

The dynamic landscape of cryptocurrencies, marked by rapid growth and high volatility since Bitcoin’s inception in 2009, has attracted significant attention from investors and traders. The emergence of new digital currencies challenges traditional financial models, necessitating advanced analytical tools to navigate the market’s unpredictability. The quest for effective trading strategies has led to the exploration of AI and machine learning techniques, which promise to enhance decision-making in this speculative yet lucrative field.

Researchers from the University of Barcelona and the University of Málaga unveiled a pioneering study (DOI: 10.3934/QFE.2024007) in the Quantitative Finance and Economics journal on March 26, 2024. Their research demonstrates the powerful integration of Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) with cutting-edge machine learning techniques to adeptly manage the volatility endemic to cryptocurrency markets. This innovative approach significantly enhances the accuracy of predictions regarding cryptocurrency trading decisions.

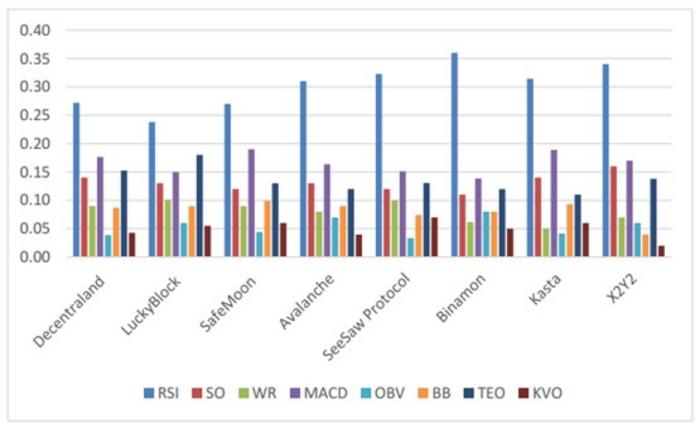

The investigation assessed several machine learning models, such as Adaptive Genetic Algorithms with Fuzzy Logic and Quantum Neural Networks, to forecast buying or selling actions across various cryptocurrencies. A key finding from the study was the superior performance of these models when combined with EGARCH, which markedly improved prediction accuracy by effectively modeling the price volatility characteristic of cryptocurrencies. Notably, the cryptocurrency X2Y2 showed the highest prediction accuracy, underscoring the potential of combining sophisticated machine learning methods with volatility models to substantially mitigate trading risks and refine investment decisions.

Dr. David Alaminos, the lead researcher at the University of Barcelona, commented, “Our method harnesses the strengths of both neural networks and genetic algorithms, augmented by the volatility modeling prowess of EGARCH. This synergy fosters more dependable market movement predictions and significantly diminishes trading risks.”

This groundbreaking methodology offers crucial tools for investors aiming to reduce risks in cryptocurrency investments. Moreover, the insights gained from this study could assist regulatory bodies in formulating policies to enhance market fairness and stability, while also aiding developers in advancing predictive algorithms for financial technologies.

Credit: Quantitative Finance and Economics

In the rapidly evolving world of cryptocurrency, volatility management remains a crucial challenge. Researchers have now developed a novel approach that integrates Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) with genetic algorithms and neural networks to enhance the precision of trading decisions in this volatile market.

The dynamic landscape of cryptocurrencies, marked by rapid growth and high volatility since Bitcoin’s inception in 2009, has attracted significant attention from investors and traders. The emergence of new digital currencies challenges traditional financial models, necessitating advanced analytical tools to navigate the market’s unpredictability. The quest for effective trading strategies has led to the exploration of AI and machine learning techniques, which promise to enhance decision-making in this speculative yet lucrative field.

Researchers from the University of Barcelona and the University of Málaga unveiled a pioneering study (DOI: 10.3934/QFE.2024007) in the Quantitative Finance and Economics journal on March 26, 2024. Their research demonstrates the powerful integration of Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) with cutting-edge machine learning techniques to adeptly manage the volatility endemic to cryptocurrency markets. This innovative approach significantly enhances the accuracy of predictions regarding cryptocurrency trading decisions.

The investigation assessed several machine learning models, such as Adaptive Genetic Algorithms with Fuzzy Logic and Quantum Neural Networks, to forecast buying or selling actions across various cryptocurrencies. A key finding from the study was the superior performance of these models when combined with EGARCH, which markedly improved prediction accuracy by effectively modeling the price volatility characteristic of cryptocurrencies. Notably, the cryptocurrency X2Y2 showed the highest prediction accuracy, underscoring the potential of combining sophisticated machine learning methods with volatility models to substantially mitigate trading risks and refine investment decisions.

Dr. David Alaminos, the lead researcher at the University of Barcelona, commented, “Our method harnesses the strengths of both neural networks and genetic algorithms, augmented by the volatility modeling prowess of EGARCH. This synergy fosters more dependable market movement predictions and significantly diminishes trading risks.”

This groundbreaking methodology offers crucial tools for investors aiming to reduce risks in cryptocurrency investments. Moreover, the insights gained from this study could assist regulatory bodies in formulating policies to enhance market fairness and stability, while also aiding developers in advancing predictive algorithms for financial technologies.

###

References

DOI

Original Source URL

Funding information

This research was funded by the Universitat de Barcelona, under the grant UB-AE-AS017634.

About Quantitative Finance and Economics

Quantitative Finance and Economics (QFE) is an international, scholarly, peer-reviewed, high quality and open access journal of finance and economics. It provides an advanced forum for communicating research results related to quantitative finance and economics. In order to promote the marginal contribution of the journal, QFE focuses on the following fields: 1) Quantitative research on the basis of indexes, like compilation methodologies for financial indexes and their data dissemination, including but not limited to financial condition indexes, digital finance indexes and so forth; 2) Financialization, including but not limited to leverage ratios, financialization behaviors of enterprises and so forth; 3) Digital finance and risk management, concerning on quantitative research of financial risk through the application of information technology, including but not limited to sovereign digital currencies and monetary policies, financial risks induced by digital finance and so forth. We publish the following article types: original research articles, reviews, editorials, letters, and conference reports.

Journal

Quantitative Finance and Economics

Subject of Research

Not applicable

Article Title

Managing extreme cryptocurrency volatility in algorithmic trading: EGARCH via genetic algorithms and neural networks

Article Publication Date

26-Mar-2024

COI Statement

The authors declare that they have no competing interests.