Facts and figures in brief

Facts and figures in brief

- In Iran, gross domestic product fell by 1.9 per cent as a result of the sanctions in 2012.

- In Russia, gross domestic product fell by 1.4 per cent in 2014 as a result of the sanctions.

- If all countries in the world were to participate in the sanctions against Iran, the economic consequences would more than double.

- Involving all countries in the world in the sanctions against Russia would increase the economic consequences by more than 70 per cent.

- China joining the sanctions coalition against Russia would increase the effect by a good 22 per cent.

- Economically strong countries would have to transfer around 5.4 billion US dollars to countries that suffer disproportionately large economic damage as supporters of the sanctions against Iran and Russia.

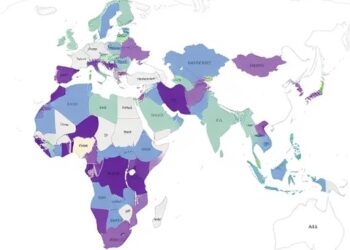

Economic sanctions can be a double-edged sword. On the one hand, they usually reduce gross domestic product and thus prosperity in the affected countries, as intended. On the other hand, however, they can also have a severe impact on the economies of the sanctioning countries. However, a skilful selection of the countries involved in the sanctions measures could significantly mitigate these undesirable negative consequences.

These are the key findings of a new study that has now been published in the journal Economic Policy. Economists Sonali Chowdhry (DIW Berlin), Julian Hinz (Bielefeld University & IfW Kiel), Katrin Kamm (IfW Kiel) and Joschka Wanner (University of Würzburg & IfW Kiel) are responsible for the study. The study focuses on the sanctions against Iran in 2012 in response to its nuclear programme and against Russia following the violent annexation of Crimea in 2014.

Analysing Prices, Prosperity and Trade Flows

“In our analyses, we focused on the economic effects of sanctions, for example on prices and prosperity in the target country, as well as on trade flows,” says Joschka Wanner, Junior Professor of Quantitative International and Environmental Economics at Julius-Maximilians-Universität Würzburg (JMU), describing the approach. As a first step, the team analysed the extent to which these parameters have changed as a result of the sanctions.

In fact, the calculations for Iran show a real decline in gross domestic product of 1.9 per cent as a result of the sanctions. For Russia, the figure is 1.44 per cent – based on the sanctions from 2014. The sanctions following the attack on Ukraine do not yet play a role in this study. “1.4 or 1.9 per cent may not sound like much. However, from an economic perspective, this is a full-blown recession,” says Wanner.

Maximum Sanction Potential not Reached

The group compared these real developments with the maximum potential of the sanctions under various conditions – either by including more countries in the sanctions or by extending them to all goods. “According to our calculations, in the case of Iran, the current coalition achieves around 39 per cent of what would be possible in terms of a decline in gross domestic product – compared to the case in which all countries participate in the sanctions,” explains Wanner. For Russia, this figure is just under 58 per cent.

These figures are partly even more drastic if the current scenario is compared with the case in which the sanctions apply to all goods, i.e. there are no more exceptions. In this case, the current coalition only achieves 47 per cent of the possible decline in GDP for Iran. And 16 per cent for Russia.

High Costs for Some Stakeholders

When sanctions are imposed, it is not only the sanctioned countries that suffer – the study also shows this. However, there are major differences: “While larger economies such as the USA, Japan and Germany get off relatively lightly, smaller countries such as Malta, Estonia and Latvia suffer relatively drastic consequences,” explains Wanner. This should come as no surprise: if a small country like Latvia restricts trade with its large neighbour Russia, this will inevitably have a greater impact than in the USA or Canada.

As a consequence, this means that Small countries pay a high price in this case, while the effects of their participation in the sanctions are only reflected in a small loss of welfare for Russia. The study also shows how things could be better: “Instead of the small countries, other states would have to join the coalition. Then the sanctions would have much greater consequences,” explains Wanner.

In the case of sanctions against Russia, the economists have calculated that the participation of China, Vietnam, Belarus, Turkey and South Korea in particular would drastically increase the potential for sanctions. This would rise from 58 per cent under the current coalition to 71 per cent – simply by China joining the sanctions coalition.

Transfer Payments for Particularly Affected Countries

Of course, it is unlikely that China will join a coalition of Western states against Russia. So what could the coalition do to ensure that as many countries as possible side with it without suffering disproportionately large economic damage? “Financial transfers” is the research team’s answer.

“Our results show that 591 million US dollars would have to be mobilised in connection with the sanctions against Iran and 4.8 billion US dollars in the case of Russia so that the members could compensate for their welfare losses due to the respective sanctions,” the study states.

The largest contributor to this “compensation fund” would be the USA, whose combined transfers for both sanctions packages would amount to around 4.4 billion US dollars. They would be followed by the UK (770 million US dollars) and Canada (553 million US dollars).

Journal

Economic Policy

Method of Research

Data/statistical analysis

Subject of Research

Not applicable

Article Title

Brothers in arms: the value of coalitions in sanctions regimes

Article Publication Date

22-May-2024

COI Statement

The authors declare no competing interests.