In the dynamic world of banking, understanding the pivotal elements that drive profitability is essential for sustainable growth. Particularly in rapidly evolving economies, such as Ethiopia, the role of corporate governance mechanisms—especially those related to gender—has garnered increasing attention. A recent study authored by Hordofa and Ionaşcu delves into this critical intersection of gender diversity on corporate boards and the financial performance of banks, highlighting how these facets interact to influence profitability outcomes.

As the global conversation on gender equality continues to advance, its implications for corporate structures cannot be overstated. Gender diversity on boards of directors is not just a moral imperative but is increasingly recognized as a strategic advantage that can lead to enhanced decision-making capabilities. The research reveals that banks in Ethiopia are no exception, where the presence of women in leadership positions adds significant value, reflecting a broader commitment to inclusivity and progressive governance.

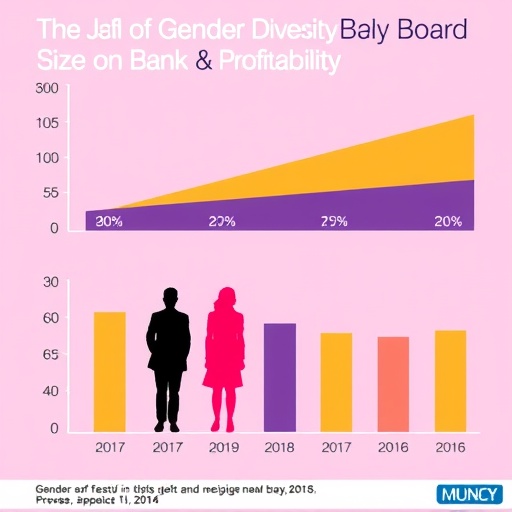

In this groundbreaking study, the authors investigate the moderating effects of board gender diversity and size on banking profitability using a comprehensive panel dataset from various Ethiopian banks. Such an approach allows for a nuanced analysis of these relationships over time and across different institutions, offering insights that are both statistically significant and widely applicable. By employing robust econometric methods, the researchers validate their hypotheses regarding the correlation between these governance attributes and profit maximization, thus paving the way for further discussions on effective governance practices in emerging markets.

One of the most striking findings of the study is the apparent interaction between board size and gender diversity. Specifically, larger boards that incorporate a higher percentage of women seem to experience enhanced profitability as compared to their male-dominated counterparts. This nuance suggests that mere compliance with gender quotas may not suffice; instead, it highlights the need to strategically cultivate an inclusive board culture that welcomes diverse perspectives, which can ultimately lead to more innovative and effective banking strategies.

In the Ethiopian context, the banking sector has been undergoing significant reforms, aiming to increase both efficiency and service quality. However, achieving these objectives requires more than just structural changes; it necessitates a cultural shift towards valuing and implementing diversity at the highest levels of decision-making. By focusing on the correlation between gender diversity and profitability, Hordofa and Ionaşcu shed light on the vital role of women in leadership positions and their potential contributions to the sector’s overall performance.

Moreover, the study addresses the critical issue of representation within the banking industry, advocating for policies that not only encourage the hiring of women but also support their progression into leadership roles. The implications of such research extend beyond the financial metrics; they resonate with broader societal trends towards gender equality and empowerment in various spheres of influence. This advocacy for increased representation aligns with the emerging global standards for corporate governance, emphasizing the importance of diversity in enhancing organizational capabilities.

As Ethiopia continues its journey towards becoming a more competitive player in the regional and global economy, understanding the dynamics between gender diversity and profitability becomes ever more crucial. The research underscores that a balanced approach to board composition can be a game-changer for how banks operate and perform. By embracing gender diversity and fostering an environment where all voices are heard, Ethiopian banks can better position themselves to navigate the complexities of financial markets.

Furthermore, as globalization intensifies competition among banks, the internal governance structures will play a fundamental role in attracting investments and ensuring long-term sustainability. The findings presented in this study offer a roadmap for both policymakers and banking institutions to create frameworks that not only comply with international best practices but also reflect the unique socio-economic contexts of Ethiopia.

The broader implications of these findings extend beyond the banking sector, suggesting that industries in Ethiopia may benefit from similar approaches to governance. By promoting gender diversity across various sectors, there can be a significant ripple effect in terms of improved economic outcomes and societal equity. The research stands as a call to action for both corporate leaders and stakeholders to prioritize inclusivity, recognizing that diverse boards are better equipped to address the multifaceted challenges faced in today’s business environment.

In conclusion, the study by Hordofa and Ionaşcu provides a vital contribution to the ongoing discourse surrounding gender diversity and its impacts on profitability within the Ethiopian banking sector. By highlighting the vital relationship between corporate governance and financial performance, this research serves as a clarion call for the importance of diverse voices in shaping the futures of organizations and, ultimately, the economy at large. As Ethiopia looks towards sustainable growth and development, the inclusion of women in leadership roles within its banks may very well be the key to unlocking untapped potential and driving lasting change in the marketplace.

Through this comprehensive analysis, the research invites a broader discussion on how gender dynamics can redefine governance practices in economies that are still in the developmental phase. It challenges existing norms and encourages stakeholders to view diversity, not merely as a compliance issue, but as a strategic opportunity for transformative growth. As the banking sector continues to evolve, the insights gleaned from this study will undoubtedly provide a foundation for future research and advocacy towards fostering gender-balanced corporate environments, both in Ethiopia and beyond.

Subject of Research: The effects of board gender diversity and size on bank profitability in Ethiopia.

Article Title: Moderating effects of board gender diversity and size on bank profitability: panel evidence from Ethiopia.

Article References: Hordofa, D.F., Ionaşcu, A.E. Moderating effects of board gender diversity and size on bank profitability: panel evidence from Ethiopia. Discov Sustain 6, 1259 (2025). https://doi.org/10.1007/s43621-025-01926-y

Image Credits: AI Generated

DOI: https://doi.org/10.1007/s43621-025-01926-y

Keywords: bank profitability, board diversity, gender diversity, corporate governance, Ethiopia.