Climate change has significantly impacted lives worldwide and prompted governments to adopt policies promoting sustainability and use of clean energy sources. This shift to clean energy has triggered increased investments in renewable energy and technologies. Clean energy assets possess a unique advantage – they are not affected by parameters influencing their traditional stock market counterparts. However, the interactions between the clean energy and traditional stock markets are not well understood.

Credit: Professor Sang Hoon Kang from Pusan National University, Korea

Climate change has significantly impacted lives worldwide and prompted governments to adopt policies promoting sustainability and use of clean energy sources. This shift to clean energy has triggered increased investments in renewable energy and technologies. Clean energy assets possess a unique advantage – they are not affected by parameters influencing their traditional stock market counterparts. However, the interactions between the clean energy and traditional stock markets are not well understood.

To fill this gap, a group of researchers led by Professor Sang Hoon Kang from Pusan National University explored the relationship between clean energy indices and major international stock markets. The researchers investigated if clean energy investments could provide stability when traditional stock markets experience turbulence. Their findings were published online on 10 July 2024 in the journal of Energy Economics.

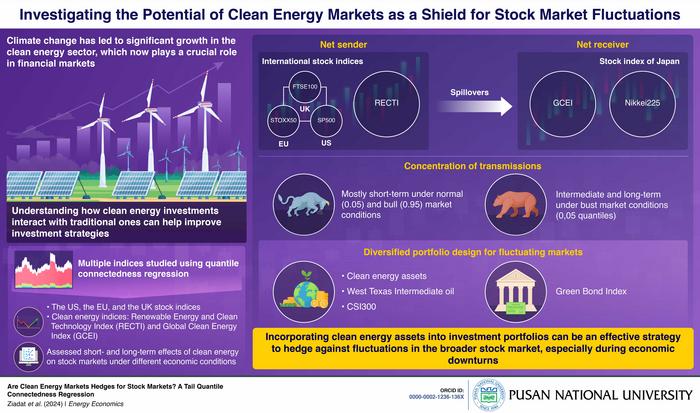

The researchers used a method called tail quantile connectedness regression to study how different financial assets interacted, especially during extreme market conditions. This method let them examine how shocks from major stock indices like the SP500 and the FTSE100, as well as the Renewable Energy and Clean Technology Index (RECTI), affect other indices such as Japan’s Nikkei225 and the Global Clean Energy Index (GCEI).

Prof. Kang explains, “Investors seek to protect their portfolios from volatility by diversifying with assets that don’t follow the same trends as traditional stocks. Clean energy assets are promising for this purpose because they are influenced by different factors, such as government policies and technological advancements in renewable energy.”

The study found that financial shocks often start in major markets like the US, the EU, and the UK, and from indices such as the RECTI, then flow to markets in Japan and the GCEI. During normal and bull market (when stock prices are increasing) phases short-term effects dominated, whereas during declining or busting market states, the impacts ranged from intermediate to long-term ones. This shows that different clean energy indices play unique roles in the global financial system, affecting how information and risks are spread across markets, and highlights their resilience and lasting influence, even in challenging economic climates.

Furthermore, the study identified specific roles played by different clean energy indices in information transmission. For instance, the RECTI tends to act actively, while the Green Bond Index remains relatively isolated. The GCEI, on the other hand, tends to receive information passively.

These findings suggest that clean energy investments can act as hedges or buffers during fluctuating market conditions, promoting financial stability and resilience against economic turbulence.

Prof. Kang elaborates, “Our findings suggest that clean energy assets paired with other financial assets such as WTI and CSI300, should form a significant portion of a diversified investment portfolio to mitigate risks during different market conditions.”

He concludes with the long-term impact of their study, “Heightened awareness and better understanding of the spillover effects between these markets can drive policy decisions that support sustainable economic growth and environmental protection, ultimately fostering a more resilient global financial system.”

In summary, the expanding clean energy sector holds great potential to promote financial stability amidst fluctuating markets.

***

Reference

DOI: 10.1016/j.eneco.2024.107757

About the institute

Pusan National University, located in Busan, South Korea, was founded in 1946, and is now the No. 1 national university of South Korea in research and educational competency. The multi-campus university also has other smaller campuses in Yangsan, Miryang, and Ami. The university prides itself on the principles of truth, freedom, and service, and has approximately 30,000 students, 1200 professors, and 750 faculty members. The university is composed of 14 colleges (schools) and one independent division, with 103 departments in all.

About the author

Professor Sang Hoon Kang received a PhD degree from UniSA Business, University of South Australia. He is currently working for Business of School, Pusan National University. He has publications in many refereed journals, including Energy Economies, Resource Policy, Finance Research Letters, International Review of Financial Analysis, Pacific-Basin Finance Journal etc. His research interests include financial time-series analysis, energy finance, and connectedness network.

ORCID ID: 0000-0002-1236-136X

Journal

Energy Economics

Method of Research

Data/statistical analysis

Subject of Research

Not applicable

Article Title

Are clean energy markets hedges for stock markets? A tail quantile connectedness regression

Article Publication Date

10-Jul-2024

COI Statement

The authors declare that they have no competing interests.