Climate Risks and Cryptocurrency Volatility: Unveiling the Nexus Between Environmental Shocks and Digital Asset Markets

The accelerating pace of climate change is posing unprecedented systemic risks to global financial markets, yet the intricate relationship between climate dynamics and the burgeoning world of cryptocurrencies remains dangerously underexplored. Unlike traditional assets such as equities and bonds, digital currencies operate within a unique technological and regulatory landscape, amplifying their sensitivity to external shocks. Recent groundbreaking research published in China Finance Review International delves into how acute and chronic climate risks intersect with regulatory and technological upheavals to influence cryptocurrency volatility during periods of crisis. This innovative study sheds light on a critical gap in financial research, notably as cryptocurrencies increasingly attract scrutiny for their environmental impact and energy consumption profiles.

Cryptocurrencies like Bitcoin and Ethereum have long been scrutinized for their immense energy usage and corresponding carbon footprint, making them prime candidates for examining climate-financial interdependencies. The research harnesses sophisticated fuzzy logic modeling—a method adept at capturing non-linear and uncertain relationships—to analyze the interactions between climate risk indices and cryptocurrency market behavior. The climate risk indices in question, namely the Physical Risk Index (PRI) and Transition Risk Index (TRI), reflect immediate environmental hazards and the financial market repercussions of shifting toward low-carbon economies, respectively. This analytical framework enables the dissection of how these intertwined risks drive volatility patterns in digital asset markets with a degree of granularity and non-linearity absent in conventional linear econometric approaches.

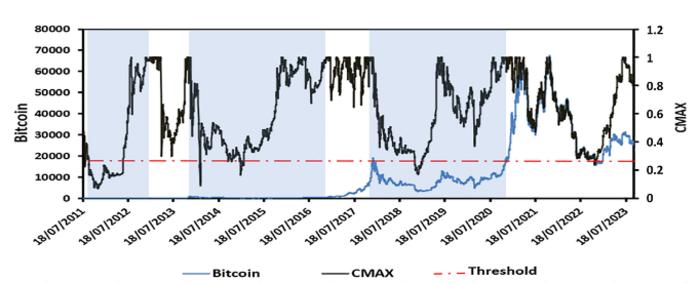

Historically, Bitcoin’s price trajectory has been susceptible to several major crises—ranging from the European sovereign debt turmoil, the infamous collapse of the Mt. Gox exchange, to phases marked by intense regulatory crackdown and the economic shocks of the COVID-19 pandemic. Overlaying these financial stress points with climate indices reveals a complex interaction where climate risks exacerbate market instability. Findings suggest that acute climate shocks, such as natural disasters or environmental catastrophes captured by PRI, and chronic, slow-burning transition risks related to regulatory reform and technological shifts, collectively intensify price volatility. The market’s turbulence is particularly pronounced during episodes of policy signaling or abrupt regulatory changes that ripple through climate and technological domains.

A salient insight from the study highlights that Bitcoin and Ethereum, representing the largest and most energy-intensive cryptocurrencies, exhibit pronounced sensitivity to climate risk shocks. Their volatility spikes notably in response to high PRI and TRI values, reflecting vulnerability to both physical environmental events and policy-induced transitions. This challenges the assumption that smaller altcoins, often perceived as less resource-intensive or peripheral, are insulated from climate-related volatility. The evidence points toward Litecoin and Ripple experiencing measurable, if somewhat muted, volatility responses, underscoring that climate risk permeates cryptocurrency markets more broadly than previously assumed.

The deployment of fuzzy logic models marks a methodological leap, moving beyond the constraints of traditional linear regression, which inadequately capture market complexities under stress. This modeling approach yielded impressive predictive accuracy, demonstrated by root mean square errors (RMSE) less than 0.02 across major cryptocurrencies, an indication of the model’s robustness. Furthermore, a visually striking three-dimensional surface plot elucidated the non-linear synergy between the PRI and TRI in driving market fluctuations. The emergence of volatility thresholds—such as PRI values exceeding 0.8 combined with TRI values above 0.7 leading to extreme market perturbations—highlights critical nonlinear dynamics that can trigger cascading effects within crypto ecosystems.

From an investor perspective, the implications are profound. Climate risk is no longer a peripheral concern but an integral dimension of portfolio risk management in digital assets. Investors are urged to incorporate climate-centric stress testing and diversification strategies that account for sharp volatility induced by environmental and regulatory signals. The risk landscape demands a paradigm shift where climate scenarios, traditionally applied to fixed income and equity portfolios, are now essential tools in cryptocurrency investment frameworks. Such approaches can help cushion portfolios against sudden market dislocations caused by climate shocks, providing greater resilience amid uncertain futures.

The study’s regulatory relevance cannot be overstated. As policymakers grapple with designing frameworks for digital currencies, integrating climate considerations emerges as a vital priority. Regulatory instruments such as carbon taxes, incentives for renewable energy adoption in mining operations, and transparency requirements stand to stabilize markets while steering the industry toward sustainability. However, given the decentralized and transboundary nature of cryptocurrency networks, unilateral national policies risk inefficacy. Global coordination and harmonized standards are indispensable for aligning financial stability objectives with climate goals in the crypto sphere.

Environmental sustainability transcends regulatory compliance and enters the technological domain, where urgent innovation is requisite. Blockchain platforms must evolve rapidly towards greener protocols, exemplified by proof-of-stake consensus mechanisms that drastically reduce energy consumption compared to traditional proof-of-work systems. Carbon offset initiatives and investments in renewable infrastructure for mining operations are no longer optional but essential to preserve social license and ecological integrity. The study’s findings amplify calls for accelerated technological transformation to mitigate the crypto sector’s environmental externalities and associated financial risks.

Looking ahead, the intersection of climate change and cryptocurrency markets demands continued, nuanced research. Emerging crypto segments—such as decentralized finance (DeFi), non-fungible tokens (NFTs), and central bank digital currencies (CBDCs)—introduce fresh dynamics and vulnerabilities. Incorporating real-time climate data streams and decoding investor sentiment through advanced analytics promise to unravel finer details of market behavior under environmental duress. Such multidimensional analyses are critical to anticipating, managing, and potentially harnessing climate-induced market disruptions within the evolving digital finance landscape.

This pioneering examination of climate risks and cryptocurrency volatility resonates amid rising global urgency to marry financial innovation with sustainability imperatives. While cryptocurrencies offer novel opportunities for democratizing finance and fostering technological advancement, their integration with planetary boundaries and climatic realities cannot be an afterthought. By illuminating the channels through which environmental risks infiltrate digital asset markets, this study provides a foundational step for investors, regulators, and technologists striving to navigate a rapidly shifting confluence of climate and finance.

The intricate dance between climate shocks, policy responses, and cryptocurrency market dynamics reflects broader transformations reshaping global finance in the 21st century. As climate events grow in frequency and intensity, their fingerprints on asset price behavior will likely deepen. Acknowledging and quantifying these interdependencies enhances our collective capacity to build resilient markets, craft informed policies, and accelerate the transition toward sustainable digital economies. This research underscores that no financial innovation, however decentralized or digitalized, is immune to the systemic forces unleashed by climate change.

Ultimately, the enduring lesson from this investigation is clear: integrating climate risk into financial models is imperative not only for traditional markets but critically so for the volatile, dynamic world of cryptocurrencies. Bridging the gap between environmental science and financial technology through interdisciplinary methodologies offers the best hope of anticipating future crises, mitigating systemic risks, and steering the crypto revolution onto a sustainable trajectory.

Subject of Research: Climate Risks and Cryptocurrency Volatility

Article Title: Climate risks and cryptocurrency volatility: evidence from crypto market crisis

News Publication Date: 31-Mar-2025

Web References: https://doi.org/10.1108/CFRI-09-2024-0575

Image Credits: Sirine Ben Yaala and Jamel Eddine Henchiri (University of Gabes, Tunisia)

Keywords: Climate change, Cryptocurrency volatility, Climate risk indices, Physical Risk Index (PRI), Transition Risk Index (TRI), Fuzzy logic modeling, Bitcoin, Ethereum, Environmental sustainability