In the contemporary landscape of data-driven decision-making, the intersection of computational design and artificial intelligence has become increasingly crucial. Researchers are continuously exploring new methodologies to leverage vast datasets for enhanced decision-making capabilities, particularly within the realm of portfolio management. A recent study conducted by R. Faridnia, titled “From data to decisions: portfolio topology optimization framework,” unveils a novel framework aimed at revolutionizing how portfolios are constructed and optimized by utilizing cutting-edge algorithms and topological principles.

The study emphasizes the importance of transforming raw data into actionable insights. Portfolio management, traditionally dominated by heuristic methods, often suffers from inefficiencies related to the static nature of conventional models. Faridnia’s framework aims to bridge this gap through dynamic data integration and real-time optimization, enabling decision-makers to adapt to fluctuating market conditions seamlessly. The transformative potential of such a framework lies in its ability to reconfigure portfolios not merely as static collections of assets but as adaptive entities that respond to new information and evolving market landscapes.

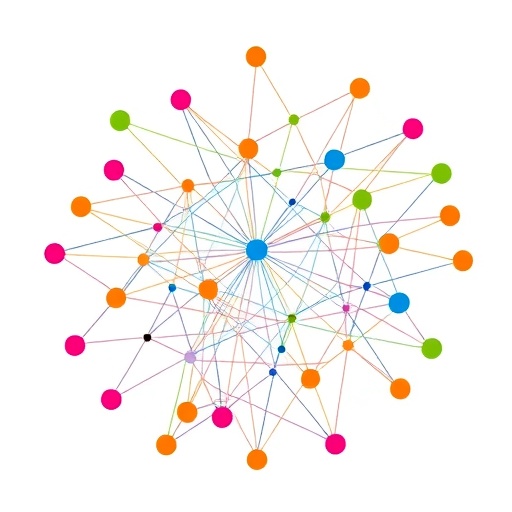

A striking aspect of the proposed framework is its reliance on topological optimization principles. The researcher elucidates how these principles can be applied to create a multidimensional representation of portfolios, allowing for the visualization and adjustment of asset arrangements in a manner that promotes optimal performance. By treating portfolios as intricate networks rather than mere aggregations of assets, the framework ensures that interactions between different components are taken into account, enhancing the overall robustness and adaptability of the portfolio.

Moreover, the framework embodies a synthesis of traditional financial theories with state-of-the-art machine learning techniques. This synthesis facilitates more sophisticated analyses of asset behavior and interdependency, which are critical for informed decision-making. By employing advanced algorithms that can process and learn from historical market data, the framework provides a pathway to generate predictive insights that are invaluable for portfolio managers seeking to navigate the inherently unpredictable nature of financial markets.

In the face of increasing complexity associated with global financial systems, the ability to efficiently process and analyze big data becomes paramount. Faridnia’s framework stands out by introducing methods that not only streamline data handling but also enhance the granularity of insights produced. The integration of advanced data analytics allows users to identify emerging trends and correlations that traditional methods might overlook, ultimately fostering a more informed investment strategy.

Additionally, the study discusses the practical implications of the framework within the investment community. Portfolio managers often contend with a myriad of choices and constraints when building a portfolio. Faridnia argues that his framework facilitates a more streamlined decision-making process by structuring the optimization phase in a user-friendly manner. This structure allows for quicker assessments of portfolio variations, empowering managers to experiment with diverse combinations of asset classes effortlessly before making definitive investment choices.

Furthermore, the validation of the proposed framework is inherently tied to its ability to deliver superior performance metrics. The research presents empirical evidence demonstrating that portfolios optimized through this methodology can outperform traditional benchmarks consistently. This finding is particularly significant for both institutional investors and individual traders who seek reliable strategies to maximize returns while minimizing risk.

The study does not merely make theoretical claims; it also emphasizes the importance of empirical testing. By conducting rigorous back-testing applied to various financial scenarios, the research provides evidence that the portfolio optimization framework can indeed yield substantial improvements over existing methods. This focus on data-driven validation underscores the credibility of the proposed model and highlights its potential applications across different trading environments.

For the framework to achieve widespread adoption, its usability across various platforms is critical. The study discusses ongoing efforts to develop user-friendly software tools that implement the framework seamlessly, making it accessible to both novice and experienced investors. By prioritizing ease of use, Faridnia aims to democratize advanced portfolio optimization techniques, empowering a broader audience to make data-driven investment decisions.

Another noteworthy aspect of this research is its alignment with the evolving needs of modern investors. As people increasingly seek ways to align their investments with personal values and ethical considerations, this framework has the potential to incorporate environmental, social, and governance (ESG) metrics into portfolio construction. The capability to optimize portfolios not just for financial returns but also with respect to these considerations could redefine the investment landscape, steering capital towards more sustainable outcomes.

The implications of Faridnia’s work extend beyond mere financial performance; they hint at a paradigm shift in the perception of what constitutes successful investing. By integrating topological optimization with machine learning, the framework is positioned to influence how investors view risk and reward, urging them to adopt a more nuanced understanding of portfolio dynamics. This paradigm shift could lead to transformative changes in investment strategies across markets globally.

Additionally, the reception within the academic and professional community appears promising. Early feedback indicates that the framework provokes further inquiry into the integration of advanced computational techniques into traditional finance. Scholars and practitioners alike are keen on exploring how such methodologies can be fine-tuned to address specific market conditions and investment goals, thus ensuring the framework remains relevant amidst the rapid evolution of market dynamics.

In conclusion, Faridnia’s innovative “portfolio topology optimization framework” presents a significant advancement in the realm of portfolio management. It effectively harnesses the power of data analytics and topological principles to enhance decision-making in ways that were previously unattainable. As markets continue to evolve, frameworks like this will likely be instrumental in equipping investors with the tools necessary to thrive in an increasingly complex financial landscape. The potential to optimize portfolios dynamically based on real-time data not only streamlines investment processes but also promises to foster a new era of informed and strategic investing.

Subject of Research: Portfolio Management Optimization

Article Title: From data to decisions: portfolio topology optimization framework

Article References:

Faridnia, R. From data to decisions: portfolio topology optimization framework.

Discov Artif Intell 5, 386 (2025). https://doi.org/10.1007/s44163-025-00253-5

Image Credits: AI Generated

DOI: https://doi.org/10.1007/s44163-025-00253-5

Keywords: Portfolio Optimization, Topology, Data Analytics, Decision-Making, Financial Markets, Machine Learning, Sustainable Investing.