In the increasingly complex landscape of corporate governance, the question of how firms allocate their surplus resources after achieving profitability has remained a critical yet underexplored issue. While companies traditionally prioritize financial performance to meet survival and growth benchmarks, the post-profit phase reveals a nuanced internal contest over resource distribution. A pioneering study conducted by an international team of scholars sheds light on the intricacies of this decision-making process by focusing on the boardroom dynamics of Chinese firms. This research uncovers how internal political coalitions within corporate boards influence whether firms prioritize shareholder payouts or social welfare initiatives.

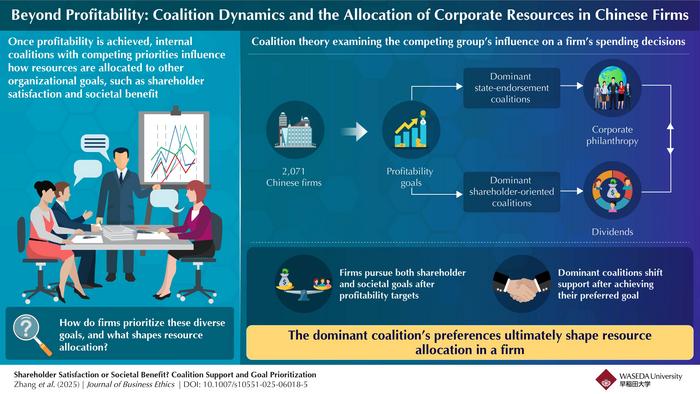

The research, published in the Journal of Business Ethics, stems from a collaboration among Professor Toru Yoshikawa of Waseda University in Japan, Associate Professor Cyndi Man Zhang from Singapore Management University, and Professor Helen Wei Hu at the University of Melbourne. Their methodological approach intricately combines data analysis with a deep theoretical framework to dissect the power structures embedded in corporate boards. By examining over 2,000 firms listed on the Shanghai and Shenzhen stock exchanges between 2008 and 2013, the study captures a representative slice of the Chinese economy, which during this period accounted for more than 84% of the nation’s GDP.

Central to the study is the theorization of two dominant board coalitions that compete to set organizational priorities once core financial goals are met. The first, termed the shareholder-value coalition, is predominantly composed of CEOs and directors with backgrounds in finance or accounting. This faction emphasizes maximizing shareholder returns, often pushing for increased dividend payments as a tangible metric of financial success. Opposing this is the state-endorsement coalition, composed primarily of individuals with prior government experience or connections. Their agenda revolves around corporate social responsibility and enhancing social welfare projects that align with broader public interests and government-driven initiatives.

Understanding these coalitions is essential because the Chinese corporate environment embodies a unique hybrid of market capitalism and pronounced state influence. Unlike Western firms where shareholder primacy often dominates, Chinese corporations reflect a more pluralistic governance model, balancing profit motives with socio-political expectations. The research meticulously maps board member profiles to coalition membership, enabling the identification of predominant influences that drive resource allocation strategies. This analytical step is critical for distinguishing the nuanced motivations behind corporate decision-making processes.

Employing rigorous statistical tools, the research team first ascertains whether each firm met established financial performance indicators. This is pivotal because resource allocation beyond this threshold reflects discretionary choices rather than survival imperatives. Once financial goals are secured, firms face the challenge of navigating competing priorities—whether to direct surplus capital towards satisfying shareholders or contributing to societal causes. The empirical findings reveal a dual commitment: both shareholder dividends and corporate philanthropy often increase after profitability targets are achieved.

However, the relative emphasis on these outcomes is not uniform across firms. Those boards dominated by the shareholder-value coalition prioritize increasing dividend payments, signaling a preference for immediate financial returns to investors. Conversely, firms under the influence of the state-endorsement coalition demonstrate significant increases in corporate donations and social investments. Intriguingly, these two objectives are not strictly mutually exclusive. When one coalition secures its primary aim, it frequently exhibits a newfound openness to supporting the alternative goal, suggesting a complex interplay between competition and cooperation within board decision-making.

These results have profound implications for our understanding of corporate governance beyond the Chinese context. They highlight the boardroom as a political battleground where subgroups vie for control, shaping the ethical and strategic orientations of firms. This framework challenges the traditional notion of boards as unified entities and instead presents them as arenas where diverse interests must negotiate priorities. The presence of coalitions advocating divergent objectives underscores the importance of internal board composition for stakeholders seeking to predict or influence corporate behavior.

From an investor’s perspective, this research advises a strategic focus on the professional backgrounds and affiliations of board members. Shareholders can better anticipate a firm’s approach to distributing economic gains once they understand which coalition holds sway. For policymakers and regulators, these insights emphasize the value of transparency around board composition to safeguard against governance conflicts that could undermine either shareholder wealth or social commitments.

Moreover, this study enriches the literature on corporate social responsibility by situating CSR initiatives within the power dynamics of governance structures. It reveals that social value creation is not merely a voluntary or altruistic add-on but is often deeply embedded in the strategic contestations within the firm. This understanding invites further exploration of how political actors within organizations shape outcomes that ripple beyond corporate walls into broader society.

The data-driven nature of this research is particularly significant given the challenge of measuring internal boardroom politics. By correlating the professional trajectories of board members with observable firm outcomes such as dividend payments and philanthropic donations, the study offers empirical validation of theoretical conjectures that were previously difficult to substantiate. This approach demonstrates the value of integrating qualitative conceptual frameworks with quantitative methods in studying corporate governance.

In addition to clarifying how firms allocate resources post-profit, the findings indirectly address long-standing debates about the alignment between business objectives and social welfare. They illustrate that alignment depends heavily on which internal coalition exercises dominance—a nuance that both critics and proponents of shareholder primacy have often overlooked. This adds complexity to existing normative discussions on the roles and responsibilities of modern corporations.

Professor Toru Yoshikawa encapsulates the study’s core insight succinctly: “While financial targets are indispensable for corporate survival, what follows reveals the underlying priorities and power struggles that define a firm’s identity. The boardroom is not a monolith, but a political arena where different factions push divergent agendas.” This statement resonates with the growing recognition that governance is as much about internal dynamics as it is about external regulations or market forces.

As the global economic environment becomes more interconnected and socially conscious, understanding these internal governance contests is vital for anticipating future corporate trends. Firms are increasingly scrutinized not only for financial performance but also for their social and environmental impacts. This research offers a blueprint for unpacking the micro-level drivers behind these multifaceted corporate responsibilities, providing a roadmap for academics, practitioners, and policymakers alike.

Ultimately, this study pushes forward our comprehension of how corporations balance profitability and societal contribution in a governance context shaped by competing interests. It invites ongoing inquiry into how boardroom politics and coalition dynamics manifest in other national and industrial settings, potentially reshaping global approaches to corporate responsibility and value creation.

Subject of Research: Not applicable

Article Title: Shareholder Satisfaction or Societal Benefit? Coalition Support and Goal Prioritization

News Publication Date: 9-May-2025

References:

Zhang, C. M., Hu, H. W., & Yoshikawa, T. (2025). Shareholder Satisfaction or Societal Benefit? Coalition Support and Goal Prioritization. Journal of Business Ethics. https://doi.org/10.1007/s10551-025-06018-5

Image Credits: Professor Toru Yoshikawa from Waseda University, Japan

Keywords: Corporations, Business, Corporate funding, Finance, Human social behavior, Economic decision making