As global concern over climate change escalates, the intersection of environmental policy and financial markets has become a critical area of analysis, particularly in the rapidly evolving context of China’s low-carbon transition. A groundbreaking study recently published in China Finance Review International examines how China’s Emissions Trading System (ETS) pilots affect the cost of equity financing for high-carbon firms, casting new light on the economic ramifications of market-based environmental regulation within emerging economies. This research not only advances our understanding of the ways environmental policy shapes corporate finance but also offers crucial insights for policymakers, investors, and financial institutions grappling with the complexities of integrating climate goals with sustainable economic development.

China launched its ETS pilots in multiple provinces beginning in 2013, aiming to establish mechanisms to control carbon emissions via market forces. Over time, this effort has evolved into what is now recognized as the world’s largest carbon trading market. However, while the environmental objectives of ETS are widely acknowledged, less has been understood about how such policies influence firm-level financial outcomes, especially in industries characterized by heavy carbon footprints such as petrochemicals, power generation, and aviation. Addressing this gap, the research delves into the nuanced cost dynamics that high-carbon firms experience as a direct consequence of ETS implementation, focusing on the variability introduced by regional economic development and firm-specific factors.

The study’s methodology is anchored in a robust difference-in-differences framework that leverages the staggered rollout of ETS pilots across Chinese provinces as a quasi-natural experiment. By comparing a comprehensive panel of A-share listed companies from 2009 to 2018, the authors isolate the causal impact of carbon trading policies on firms’ equity costs. The cost of equity is estimated using the Capital Asset Pricing Model (CAPM), a benchmark financial model that links expected returns to the systematic risk of a firm’s stock. Crucially, the analysis controls for an array of firm-level and regional characteristics, ensuring that the observed financial variations can be confidently attributed to the ETS intervention rather than confounding factors.

The results reveal a striking economic consequence: the introduction of ETS leads to an average increase of approximately 0.3 percentage points in the cost of equity for high-carbon firms located in pilot provinces relative to those outside these regions. This incremental financing burden reflects the heightened risk and operational uncertainty these firms face as they comply with emissions caps and navigate carbon quota purchases. The increased volatility in operational cash flows and stock returns translates directly into greater equity risk premiums demanded by investors, underscoring a fundamental shift in how market participants perceive and price environmental regulatory risks.

Not all firms are impacted equally, however. The data illustrates a pronounced heterogeneity based on firm ownership and financial health. State-owned enterprises and firms with robust institutional backing appear more resilient in absorbing the elevated financing costs imposed by ETS. Their access to capital and preferential policies enables them to weather regulatory pressures with comparatively less financial strain. In contrast, private and financially constrained firms experience significantly steeper increases in their equity costs, reflecting their vulnerability to liquidity constraints and limited fallback options in the face of emissions trading costs. This dichotomy highlights critical equity considerations in the design and implementation of market-based environmental mechanisms.

Regional institutional quality emerges as a decisive moderating factor in the study’s findings. Provinces characterized by advanced governance structures, higher levels of urbanization, and sizable, diversified markets exhibit stronger ETS effects on firm financing conditions. Sophisticated local institutions not only enforce regulations more effectively but also create an environment in which market participants adjust expectations and behaviors in response to policy signals. Conversely, areas with weaker institutional frameworks display attenuated financial reactions to ETS, suggesting that policy efficacy is deeply intertwined with local administrative capacity and market maturity.

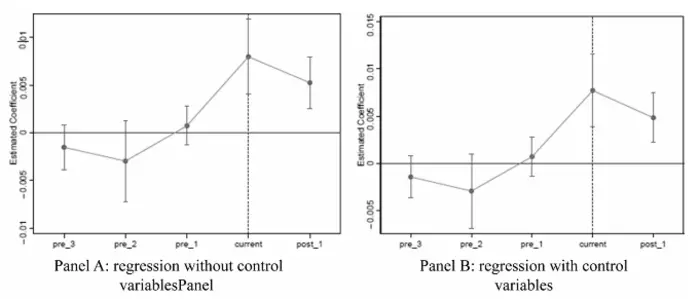

The researchers also extend their analysis through numerous robustness checks, including alternative empirical specifications, matching techniques, and subsample investigations. These additional layers of validation reinforce the credibility of the core conclusions and demonstrate the methodological rigor applied. Particularly innovative is the decomposition of the primary independent variable into temporally disaggregated dummy indicators capturing distinctive years before and after ETS enactment. This approach allows the identification of temporal patterns in financial adjustments, enhancing the granularity of the policy impact assessment.

From a broader perspective, this research advances the discourse on environmental fiscal policy by illuminating an often-overlooked channel through which climate regulation affects corporate behavior: the cost of capital. By directly linking emissions trading to increased equity financing costs, the study provides empirical evidence that environmental sustainability and financial market dynamics are intricately connected. Such insights are essential for integrating environmental externalities into traditional financial analysis frameworks, thereby fostering more comprehensive risk management and investment decision-making practices.

The policy implications flowing from these findings are profound and multifaceted. For governments, the study underscores the necessity of tailoring ETS frameworks to accommodate regional disparities and firm heterogeneity. Blanket policies risk exacerbating financial distress among vulnerable firms, potentially stalling their green transition and impairing broader economic competitiveness. Policies that provide targeted financial support or incentives for non-state and financially fragile enterprises could smooth this transition. For regulators, strengthening local governance and market institutions appears critical to magnifying policy effectiveness and ensuring equitable outcomes.

The financial sector also stands to benefit from the insights presented. Banks and investors should recalibrate their risk assessment models to incorporate the heightened equity risk associated with ETS-exposed firms, particularly those without strong institutional backing. Appreciating the nuanced risk profiles induced by environmental regulation can facilitate the design of innovative financial products—such as green bonds or blended finance instruments—that alleviate capital constraints and promote sustainable investments. Portfolio managers can optimize investment strategies by integrating environmental risk factors linked to ownership structures and regional policy contexts.

Moreover, researchers within the fields of finance, environmental economics, and corporate governance are invited to build upon this study’s methodology and findings. The intersection of regulatory intervention and market response presents fertile ground for further exploration, especially as emerging markets undergo parallel low-carbon transitions. Investigating the long-term dynamics between environmental compliance, financial market development, and corporate adaptation will be crucial for designing effective and sustainable climate finance policies globally.

Ultimately, this study presents compelling evidence that China’s ETS pilots have already begun to reshape how environmental policies influence firm financing conditions. While advancing decarbonization objectives, the system also introduces notable financial pressures, especially for non-state-owned and financially constrained high-carbon firms. Recognizing and addressing these challenges through nuanced policy design and financial innovations will be essential to harmonizing environmental imperatives with economic vitality. The findings resonate beyond China, providing valuable lessons for countries worldwide grappling with the financial implications of climate regulation.

As the global economy accelerates toward net-zero emissions, understanding the real costs imposed on high-pollution sectors offers a crucial perspective. Environmentalists, economists, and financial market participants must collaborate to ensure that emissions trading systems and similar mechanisms do not unintentionally stifle enterprise innovation or competitiveness. Instead, well-calibrated environmental finance policies can stimulate green transformation while managing risk prudently, proving integral to a sustainable economic future.

In summary, this compelling new research equips a broad spectrum of stakeholders with critical insights into the financial repercussions of carbon emissions trading, highlighting the complex interplay between regulatory frameworks, firm characteristics, and regional contexts. It calls for adaptive policies, innovative finance solutions, and rigorous academic inquiry to navigate the multifaceted challenges posed by climate change finance, thereby charting a more sustainable path forward.

Subject of Research: The impact of China’s Emissions Trading System (ETS) pilots on the cost of equity financing for high-carbon firms, accounting for firm ownership, financial constraints, and regional institutional quality.

Article Title: Carbon emissions trading system and the cost of equity for high-carbon firms

News Publication Date: 5-Jun-2025

Web References:

Image Credits: Weidong Xu, Xinyu Liu and Danyu Zhu (Zhejiang University, China).

Keywords: Carbon, Emissions Trading System, Cost of Equity, High-Carbon Firms, Environmental Regulation, China, Financial Markets, Market-Based Instruments, Corporate Finance, Climate Policy