Fukuoka, Japan —The climate crisis is hitting home with more frequent extreme weather events. Companies, particularly those in high-emission industries, are major contributors to global carbon emissions, therefore making them key players in the fight against climate change. Recognizing this responsibility, many businesses are now taking proactive measures to reduce their carbon footprint, by reducing carbon emissions and transparently sharing their environmental strategies and data.

Credit: Kyushu University

Fukuoka, Japan —The climate crisis is hitting home with more frequent extreme weather events. Companies, particularly those in high-emission industries, are major contributors to global carbon emissions, therefore making them key players in the fight against climate change. Recognizing this responsibility, many businesses are now taking proactive measures to reduce their carbon footprint, by reducing carbon emissions and transparently sharing their environmental strategies and data.

The Task Force on Climate-Related Financial Disclosures (TCFD) offers companies a framework to share climate-related financial information, allowing them to better navigate the risks and opportunities of climate change. In recent years, support for TCFD has surged, and Japan stands out as a leading proponent of such disclosures. However, how TCFD disclosures improve a company’s financial performance and provide tangible benefits remains underexplored.

To address this gap, a research team from Kyushu University analyzed data from approximately 2,100 Japanese listed companies over five years, from 2017 to 2021. This study, one of the first to use holistic TCFD and corporate data in Japan, was published in Corporate Social Responsibility and Environmental Management on May 20, 2024.

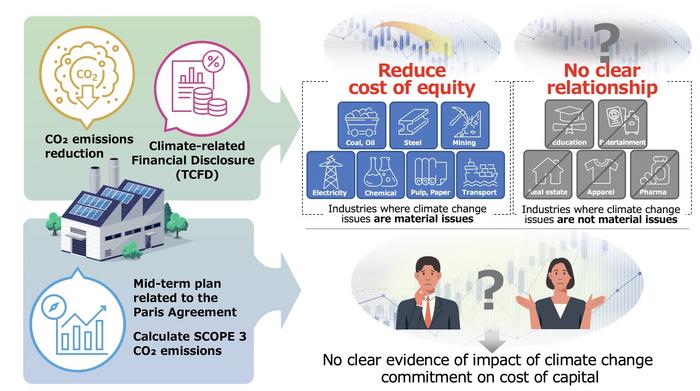

The research focused on the impact of corporate climate change actions, including carbon performance, climate-related disclosures, and corporate commitments. Researchers analyzed how these actions affect the cost of capital, which refers to the costs incurred by a company to finance its operations. The results show that companies with higher carbon emissions face higher costs for borrowing and raising money. However, those that follow TCFD guidelines and openly share climate-related information benefit from lower capital costs. Additionally, simply making promises about climate action does not significantly impact financial costs. Stakeholders are more concerned with what companies actually do rather than what they say.

One key finding is that high greenhouse gas (GHG) emissions increase climate change risks, both physical risks, such as extreme weather events, and transition risks, like regulatory changes. These increased risks create uncertainties that drive investors and lenders to demand higher returns, resulting in higher costs of equity (CoE) and debt (CoD). CoE is the return that investors expect for buying a company’s stock, while CoD is the fees a company pays to borrow money from lenders such as banks.

To reduce these uncertainties and avoid unexpected losses, investors seek to make more informed decisions by understanding and assessing a company’s climate change risks. Transparency in climate change-related data thus becomes crucial. As Siyu Shen, a graduate student at Kyushu University’s Graduate School of Economics and the paper’s second author, explains, “When companies share climate-related data, it gives investors and consumers a clearer picture of their environmental efforts, making them more likely to invest. We found that this kind of openness is particularly important in energy sectors like electricity and oil, where climate change is a major issue.”

Notably, while the study found that following TCFD guidelines effectively reduced the cost of equity, it did not have a significant impact on the cost of debt. This might be attributed to Japan’s negative interest rate policy during the study period, where the Bank of Japan kept borrowing costs low by injecting large amounts of funds into the market. With the end of this policy in March 2024, interest rates in the Japanese bond market are expected to rise. In this context, sustainable linked loans, which provide loans for decarbonising energy transition at low interest rates, are becoming increasingly popular. In 2024 and beyond, corporate climate change mitigation actions in Japan could have the potential to lower the cost of dept.

Although this study focuses on Japan, it provides valuable insights for investors, companies, and policymakers worldwide by highlighting the connection between climate disclosures and capital costs. From 2022, companies listed in Japan’s prime markets have been mandated to follow TCFD guidelines. While more companies are engaging in climate mitigation, it’s time for them to consider additional strategies to differentiate their carbon performance.

A series of environmental economic studies, including this one, have spurred research collaborators Professor Shunsuke Managi and Associate Professor Alexander Ryota Keeley from Kyushu University’s Faculty of Engineering to establish aiESG, a start-up that utilizes AI-based system to analyze the sustainability of global supply chains. Looking ahead, the research team plans to expand their analysis globally to see how regulations and cultural differences impact the relationship between climate change, carbon performance, and capital costs in various regions. They aspire to become one of the leading teams in climate impact research.

Collaboration among investors, companies, academics, and policymakers is indispensable for tackling the global climate crisis and achieving carbon neutrality. “We hope our research provides the scientific evidence needed to support companies in developing new strategies, changing behaviors, and ultimately reducing emissions,” notes Hidemichi Fujii, Professor at Kyushu University’s Faculty of Economics and the corresponding author of the study.

###

For more information about this research, see “How corporate climate change mitigation actions affect the cost of capital,” Yizhou Wang, Siyu Shen, Jun Xie, Hidemichi Fujii, Alexander Ryota Keeley, Shunsuke Managi, Corporate Social Responsibility and Environmental Management,

About Kyushu University

Founded in 1911, Kyushu University is one of Japan’s leading research-oriented institutes of higher education, consistently ranking as one of the top ten Japanese universities in the Times Higher Education World University Rankings and the QS World Rankings. The university is one of the seven national universities in Japan, located in Fukuoka, on the island of Kyushu—the most southwestern of Japan’s four main islands with a population and land size slightly larger than Belgium. Kyushu U’s multiple campuses—home to around 19,000 students and 8000 faculty and staff—are located around Fukuoka City, a coastal metropolis that is frequently ranked among the world’s most livable cities and historically known as Japan’s gateway to Asia. Through its VISION 2030, Kyushu U will “drive social change with integrative knowledge.” By fusing the spectrum of knowledge, from the humanities and arts to engineering and medical sciences, Kyushu U will strengthen its research in the key areas of decarbonization, medicine and health, and environment and food, to tackle society’s most pressing issues.

Journal

Corporate Social Responsibility and Environmental Management

DOI

Method of Research

Data/statistical analysis

Subject of Research

Not applicable

Article Title

How corporate climate change mitigation actions affect the cost of capital

Article Publication Date

20-May-2024