Global Maritime Trade Faces Unprecedented Turmoil Amid US-China Trade War Tariff Pause

In a seismic development reshaping international commerce, the recently declared 90-day suspension of tariffs in the ongoing trade dispute between the United States and China threatens to disrupt global maritime trade far more profoundly than the initial tariff escalations. The intense tariff impositions had led to a near halt in maritime traffic between these two economic giants, causing US port trade volumes to plummet by nearly 60 percent. However, the impending tariff pause introduces a “rebound effect” of dramatic proportions—forecasted to amplify demand for shipping capacity by as much as 150 percent, posing new challenges that echo the disruptions witnessed during the global Covid-19 pandemic.

These insights emerge from an in-depth collaborative study conducted by the Complexity Science Hub (CSH), the Supply Chain Intelligence Institute Austria (ASCII), and Delft University of Technology. Employing sophisticated computational models, the analysis meticulously simulates the intricate global maritime container trade network, capturing dynamic shifts prompted by recent trade tensions. Maritime transport, which constitutes approximately 90 percent of worldwide trade by volume, is under severe threat from these sudden and volatile trade fluctuations, with repercussions destined to extend well beyond the US-China corridor to affect global supply chains, including European markets.

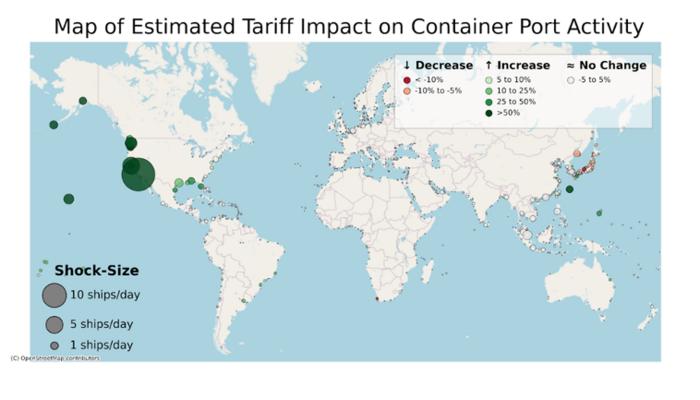

The core of the challenge lies in the interplay of disrupted supply chains and the nature of the tariff pause itself. While the initial phase of the trade war led to a near-total blockade of commercial shipments—effectively freezing inventory flows—the sudden suspension of tariffs is expected to catalyze a massive surge of container shipments as firms rush to replenish depleted stocks and clear backlog orders. If companies hesitate within this 90-day window due to uncertainty or strategic timing, the rebound might be delayed but dramatically intensified afterward. The simulations predict that container arrivals at key US West Coast ports will swell precipitously, with Long Beach-Los Angeles projected to see a 73 percent increase in ship arrivals, equating to roughly 19 additional vessels per day. Corresponding increases of 61 and 56 percent are anticipated in Oakland and Tacoma, respectively, driving an overall US container traffic surge nearing 19 percent.

Such abrupt spikes in shipping volume threaten to overwhelm port infrastructure and logistics systems already strained by structural bottlenecks. Analysts draw direct parallels to the operational chaos experienced during the Covid-19 pandemic, when many vessels lingered offshore for in excess of 20 days awaiting berth assignments. Without targeted interventions, similar port congestions could cascade into widespread supply chain breakdowns, triggering significant delays and elevated freight costs. The increased pressure on maritime logistics will inevitably ripple into elevated costs and extended lead times for importers and exporters worldwide, especially European companies interconnected with trans-Pacific trade flows.

The trade conflict has already induced significant operational shifts in global shipping patterns. Pre-conflict, approximately 500 container vessels plied routes between the US and China—representing 6 percent of the global container fleet potentially impacted by tariff-induced disruptions. The enforced tariff hikes dampened demand for previously ordered goods, compelling extensive cancellations and rerouting of shipments. This disruption spawned “blank sailings,” where around 10 percent of scheduled voyages were canceled during April and May 2025, compared to peak pandemic levels where cancellations hit 20 percent. Consequently, container handling became less predictable, with orphaned shipments and capacity misalignments exacerbating logistical complexities.

A geopolitical byproduct of this maritime turmoil has been the redirection of global shipping routes. The collapse of cross-Pacific trade volumes on the US West Coast has paradoxically benefited ports in Europe and South America, which have absorbed redirected flows. For example, Long Beach-Los Angeles experienced a steep theoretical decline of over 63 percent in container ship calls—approximately 17 fewer ships daily. Meanwhile, Chinese ports like Ningbo saw only modest traffic reductions—around 4 percent—owing to diversified trade routes. The surplus shipping capacity liberated from the Pacific shift has been redeployed, inflating vessel traffic by 5 percent in South America and 2 percent in Europe. While these adjustments offer temporary relief, they also stress alternative ports and routes, potentially creating new chokepoints if demand patterns reverse sharply during the rebound phase.

The simulation model underpinning these findings, known as TIDES, integrates a comprehensive dataset encompassing 1,315 container ports and approximately 10,000 container ships globally. By modeling maritime container trade as a network transport process, TIDES enables a granular assessment of how tariff-driven policy shifts perturb port calls, shipping frequencies, and cargo flows. This rigorous approach provides compelling evidence that political maneuvers in trade policy can cascade rapidly into tangible disruptions in complex global supply chains.

Researchers urge policymakers and port authorities to implement proactive and coordinated measures to mitigate the looming risks. Investments in port infrastructure, enhanced logistical coordination, and dynamic capacity management emerge as critical priorities. Simultaneously, companies are encouraged to pursue supply chain resiliency strategies, including strategic warehousing and diversification of procurement sources, to buffer against sudden demand fluctuations and mitigate the risks of operational bottlenecks. The study highlights that fluctuating trade policies can trigger destabilizations within global supply chains within weeks, underscoring the urgency of preemptive action.

The implications extend beyond immediate trade recovery concerns. The trade war and resulting maritime disruptions serve as a powerful illustration of the fragility of globalized supply chains in the face of geopolitical conflicts. They also serve as a cautionary tale about the broader economic risks of short-term tariff measures and the necessity for carefully calibrated international trade frameworks that minimize unintended cascade effects. As global commerce enters this critical recovery phase, aligning economic strategies with infrastructural readiness and multilateral cooperation will be pivotal to stabilizing pivotal maritime trade arteries.

In concluding observations, study authors emphasize that this trade conflict represents a critical wake-up call. It starkly demonstrates how swiftly political decisions—in this case, tariff escalation and suspension—can translate into pronounced disruptions in physical trade flows, port operations, and global supply chain health. With nearly all goods traversing seas via container vessels, the maritime domain remains a vulnerable nexus susceptible to policy volatility. The resilience of global trade networks and the stability of economic systems in the coming months will hinge on the effectiveness of mitigation efforts and the resolve to navigate through the challenges of this unprecedented rebound effect.

Subject of Research: People

Article Title: Global Maritime Trade Faces Unprecedented Turmoil Amid US-China Trade War Tariff Pause

News Publication Date: May 27, 2025

Web References:

- Complexity Science Hub: https://csh.ac.at/

- Supply Chain Intelligence Institute Austria: https://ascii.ac.at/

Image Credits: ASCII

Keywords: Globalization, International trade, Commerce, Economic recovery, Modeling